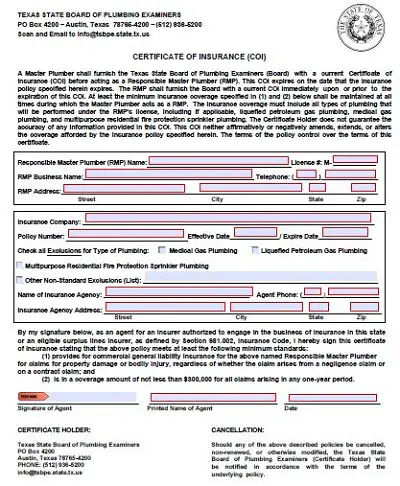

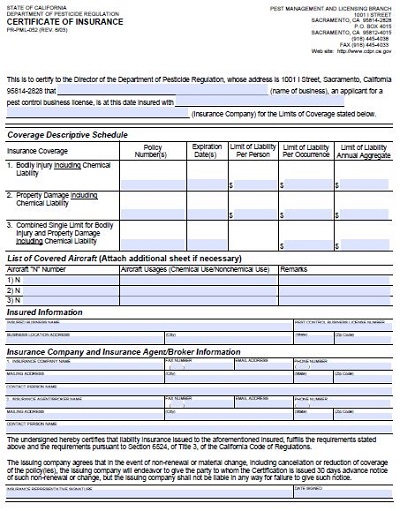

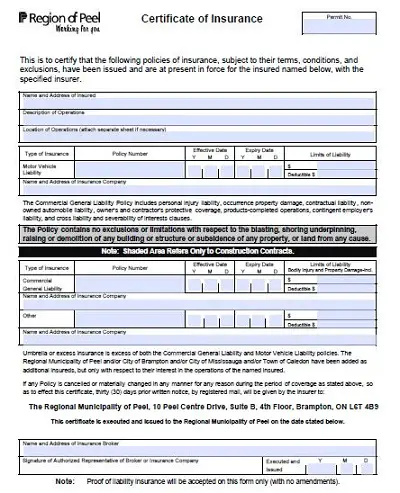

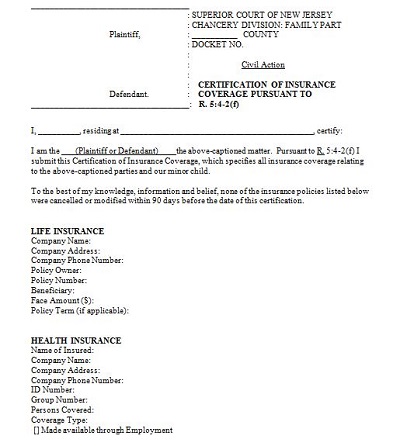

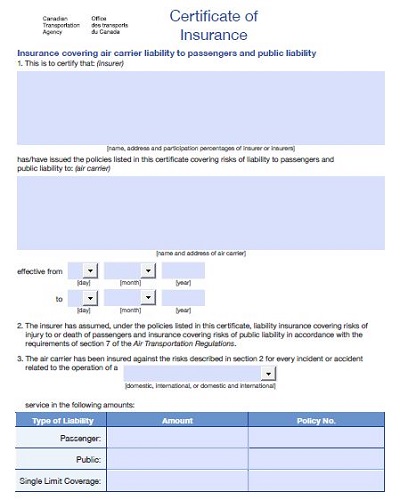

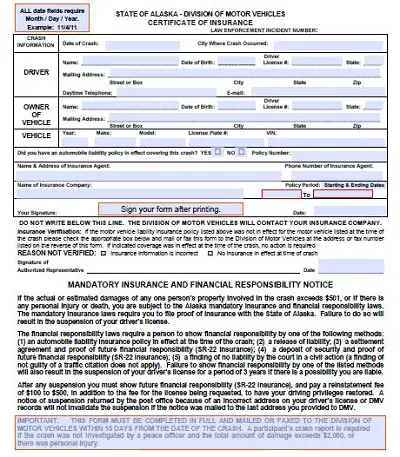

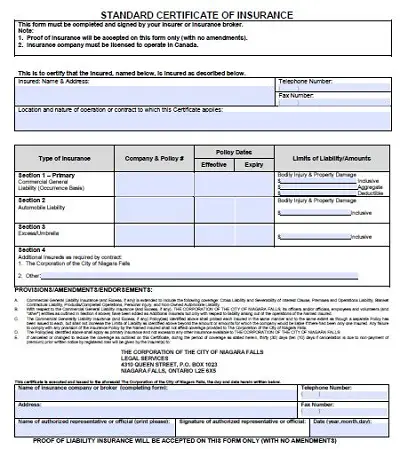

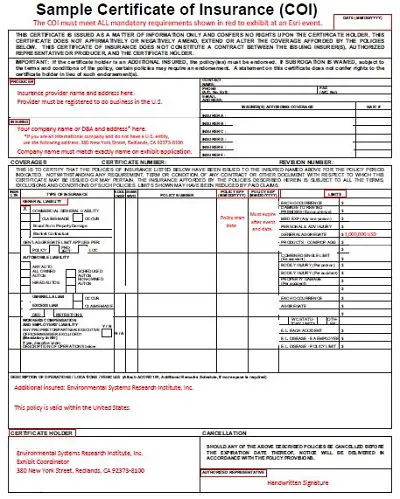

It is a certificate or a document issued by an insurance company or a broker. This certificate of insurance verifies the existence of an insurance policy. It summarizes the key aspects and the condition of the policy. For example, a standard certificate of insurance consists of a policyholder’s name, policy effective date, a policy number, a type of coverage, policy limits and other essential details of the policy. The certificate also provides evidence that certain insurance policies are in place on the date the certificate is issued. A certificate of insurance is a non-negotiable document issued by an insurance company or its broker. Insurance guarantees compensation for particular loss damage, illness or death in return for a payment of payment is called a premium.

Table of Contents

Without a certificate of insurance, a company number or a contractor will have to face difficulty in securing clients.

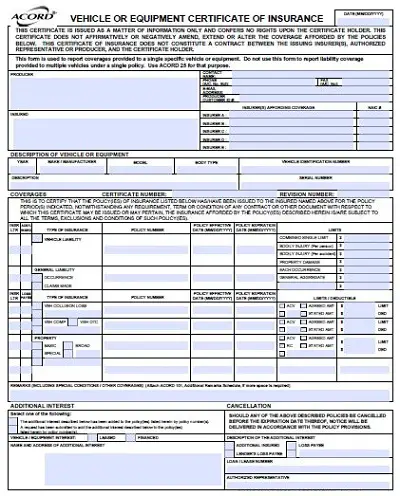

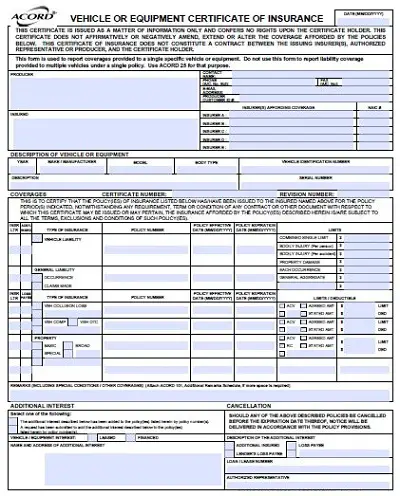

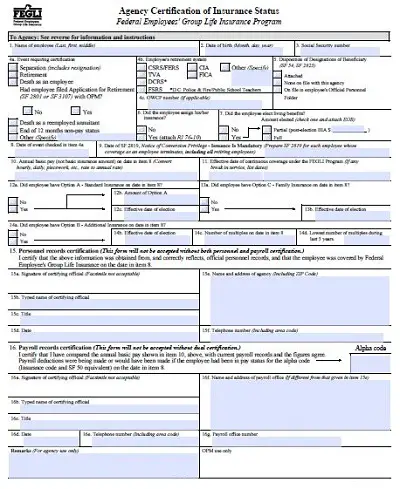

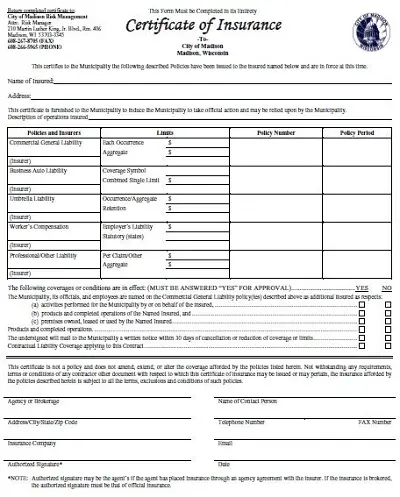

The insurance certificate has very impartance. It briefly describes the insured policies and the limits that are provided for every kind of coverage. Its general liability section summarizes six limits and the policy offers by category. It indicates the coverage applies on a per claim or per occurrence basis. The state laws determine the benefits provided to injured workers, and the worker’s compensation coverage will show no limit, but an employee’s liability coverage limits must be listed. When a client requests for a certificate of insurance, he becomes a certificate holder.The certificate policy holder’s name, mailing address. The insurance company address is listed.if several insurance companies are involved. All names and information must be documented. Its impotence increases when small business owners and contractors require a certificate of insurance it guarantees protections against liability for workplace accident and clients checks policy coverage dates and the limits of the policy.

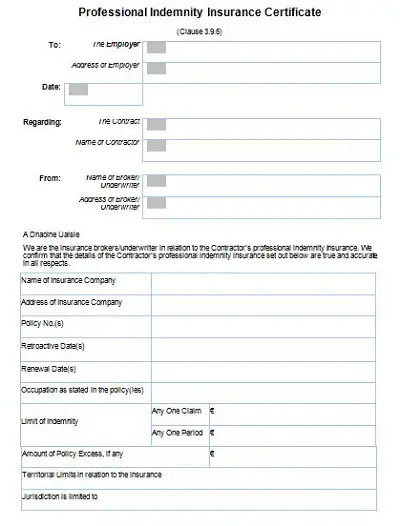

An insurance certificate template is a series of documents issued by an agent on behalf of an insurance company and stated that a policy had been issued on insured biases. The details of the insured persons are the name of an insurance company, a company logo. The insurance company agents take the insurance company certificate to be presented to their clients as the copy of the overall coverage of their company to them.

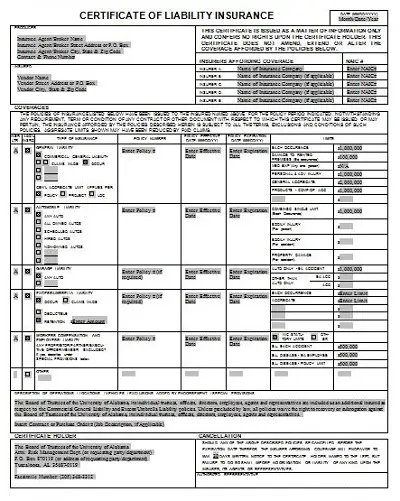

An insurance certificate template is also sometimes called a certificate of liability insurance. It provides essential information about business insurance policies. It is a one-page document that can be used as proof of insurance. It includes policy details and business so owners can find and share easily without revealing other private information.

The companies often require business, and they partner with to carry liability insurance. Because they don’t face a risk of being held solely responsible for any damage stemming from the collaboration, for example, say to the company that hires a contractor who doesn’t have general liability. That company may end up paying for any damage or any injuries caused by a contractor’s work if the contractor has proof of coverage, the company is well informed about the contractor is standing behind their work.

The business owners who need liability coverage and certificate of insurance immediately apply for it to show the proof of liability. Insurance, especially small business owners, are very conscious of keeping a certificate of liability insurance or certificate of insurance as a proactive measure. This certificate becomes able to present a proof of insurance, and it immediately demonstrates a degree of professionalism and trustworthiness that can help you in growing your business.

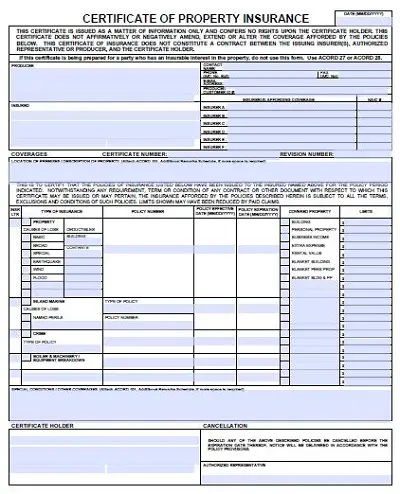

The certificate of insurance PDF template provides you with comprehensive details that are usually contained in an insurance policy. The certificate contains information on the types and limits of coverage, policy number, policyholder name, beneficiary name, an insurance company, the procedures, productive periods and other essential details.

A blank certificate of insurance is free to print for word. It is easy to hand out and used for all kinds of business occasions. It is a perfect solution. In this kind of certificate, a great performance, efforts, services and quality of an individual can be rewarded. By rewarding this blank certificate of insurance, you can capture your receiver’s attention. It will help you to achieve mutual goals. It can cancel or change to reduce the coverage outlined on the certificate during the period of coverage as stated herein thirty days or fifteen days. If the cancellation is due to non-payment of premium, prior written notice by registered mail will be given to the concerned city at the address provided for notification and communication in the contract.

Download this free blank certificate of the insurance template and customize its text, content, position, change the fonts, add your pictures, logos style and details.

A certificate of liability insurance is a simple form. Ii protects from financial obstacles resulting from accidents. An insurance company issues it. Its details are the types of coverage, the insurance company’s policy number, insured name, the effective policy date, the types and dollar amount of limits and deductions. This certificate is issued as a matter of information only.and it confers no right upon the certificate holder. These kinds of certificate affirmatively amend, extend and alter the coverage don’t constitute a contract between the issuing insurance authorities representatives or procedure and the certificate holder.

If you have your own business, the blank liability insurance certificate protects you from many potential losses, including a lawsuit by a customer. For example, if there is an accident or an injury in your workplace caused by one of your employees. A blank certificate of liability insurance PDF serves as proof of insurance coverage. It depends on the nature of your organization where you are located. This certificate must be retained for a minimum of five years.

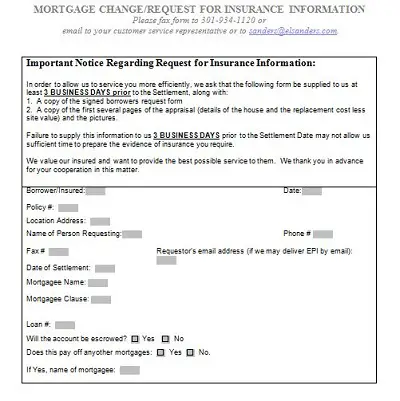

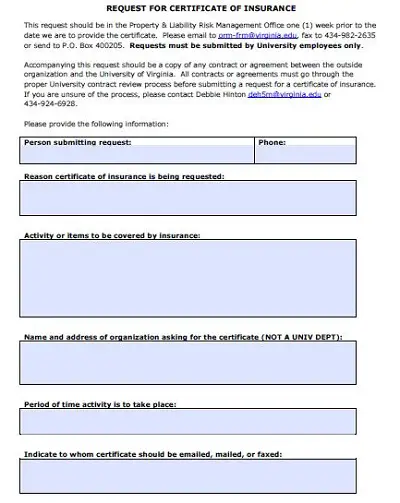

The certificate of a request form is a useful insurance company that provides an insurance certificate to the customer by his agents. The worker can easily request their insurance certificates online. It includes policyholders name, policy number, email address, phone number, name of the certificate holder, address of certificate holders, detailed job description, job location and project types.

With insurance of certificate request form template, you can give your customers proper quotes, and you can download an insurance request form template.

Policy Information

It consists of the following features.’

Insured business number

If this related to any event, and If yes, then provide event details

Event type

Type of an event and if you are an event sponsor?then information about it

Fake Insurance Certificate

If the subcontractor provides a fake or fraudulent insurance certificate, then it means you think that no coverage bit is not true. There may be covered, but your insurance policies may be the policies providing it. When you require an insurance certificate from your subcontractors to minimize the risk to your own business from the acts of others, then verify the evidence of coverage. It must be made at once.when a certificate is received. The invalid certificate is more than a nuisance, talk to your insurance broker about the methods to verify the insurance certificate.

The following points indicate a fake or falsified insurance certificate.’

The people provide fake or falsified insurance certificates during their job. How can prove it has been a fake one. With today’s technology, it can be hard to determine, but there are some signs to know it is genuine or fake.

If the certificate is in pretty bad shape means copied much time. It can be considered fake.

Its font must be matched up. An automated certificate system will use the same font throughout the document. If the certificate holder provided information looks different from the rest of the document it may be fake.

If the certificate appears to have been whited out in certain areas, indeed it is fake.

If the name, address and phone number of the insurance broker are written on the certificate. The forged documents may omit some contact information to make the information harder to verify.

In short, a certificate of insurance is a document that is issued by a company or a broker. It verifies the existence of the insurance policy.